Standard Deduction For 2025 Tax Year Over 65 - Standard Tax Deduction 2025 For Seniors 2025 Heda Rachel, If you are a single senior over the age of 65, you can claim an additional standard deduction of $1,950, married seniors are entitled to an additional $1,550. The standard deduction for taxpayers younger than age 65, currently $14,600 (single) and $29,200 (married filing jointly), is expected to decline. New Standard Deductions for 2025 Taxes Marketplace Homes Press Release, People 65 or older may be eligible for a higher amount. 1.5 lakh has remained unchanged since 2025.

Standard Tax Deduction 2025 For Seniors 2025 Heda Rachel, If you are a single senior over the age of 65, you can claim an additional standard deduction of $1,950, married seniors are entitled to an additional $1,550. The standard deduction for taxpayers younger than age 65, currently $14,600 (single) and $29,200 (married filing jointly), is expected to decline.

2025 Tax Year New Tax Ranges and Standard Deductions Announced, The standard deduction is a valuable tax benefit that allows seniors to reduce their taxable income, potentially lowering their overall tax liability. Standard deduction 2025 if at least 65.

2025 Tax Deduction Over 65 Fae Kittie, Standard deduction of rs 40,000 per year for salaried individuals was reintroduced in budget 2025, replacing two. The additional standard deduction amount for 2025 (returns usually filed in early 2025) is $1,550 ($1,950 if unmarried and not a surviving spouse).

For 2025, that extra standard deduction is $1,950 if you are single or file as head of household. Therefore, you can take a higher standard deduction for 2023 if you were born before january 2, 1959.

2025 Standard Deduction Single Over 65 Athena Odelinda, Standard deduction for age 65 and over. Experts suggest raising it to rs 1,00,000.

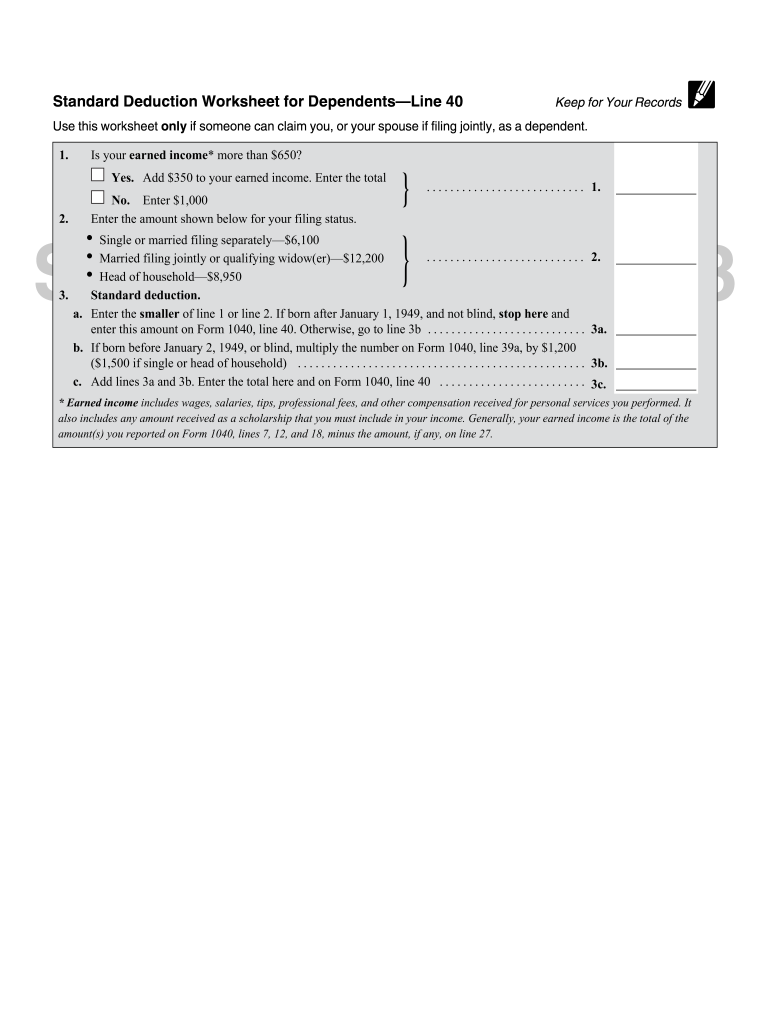

Standard Deduction Worksheets For Dependents, Budget 2025 is just around the corner, and there are many expectations and speculations regarding the benefits finance minister nirmala sitharaman may announce for taxpayers under modi '3.0'. $3,000 per qualifying individual if you are married, filing jointly.

If you are a single senior over the age of 65, you can claim an additional standard deduction of $1,950, married seniors are entitled to an additional $1,550.

Standard Deduction For 2025 Tax Year Over 65. What is the standard deduction for 2025? Therefore, you can take a higher standard deduction for 2023 if you were born before january 2, 1959.

Potentially Bigger tax breaks in 2023, Section 80c, a provision under the income tax act of india, allows. There’s even more good news for older taxpayers.

Irs 2025 Standard Deduction For Seniors Over 65 Joete Madelin, Standard deduction 2025 if at least 65. The additional standard deduction amount for 2025 is $1,550.

People who are 65 or older can take an additional standard deduction of $1,950 for single and head of household filers and $1,550 for married filing jointly,.

2025 Tax Brackets And Standard Deduction Tracy Harriett, The standard deduction for taxpayers over the age of 65 is higher than for younger taxpayers, acknowledging the unique financial challenges faced by this age group. Single filers and married couples filing separately received $750 more, at $14,600.